In past blog posts, we’ve spoken about not ‘Getting caught in the Rearview mirror’.

Today, more and more businesses are discovering the benefits of shortening and improving the Procure to Pay (P2P) cycle by implementing an Approval Routing Purchase Requisition (Procurement) and AP Automation solution – end-to end P2P.

We can show you how best-in-class companies are harnessing this technology to simplify ‘complex and outdated’ processes; leap into the 21st century and take advantage of agile business processes.

One of the most important reasons to automate your P2P process – improved cash flow.

According to The Institute of Financial Management (IOFM), the entire P2P process is the “strategic business partner” for cash management.

Proper governance of cash flow can help a business better prepare for the future, take advantage of dynamic or early pay discounts and avoid late payment penalties, while maintaining a better business relationship with vendors, suppliers and ultimately customers.

By investing in Procurement and AP Automation Software, or better stated, the Procure to Pay (P2P) process, you’ll increase efficiency, save time and improve cash flow by implementing dynamic solutions.

Need a good reason to automate? Here’s a few:

Real-Time Approvals:

Automating your Procurement and AP process allows you to securely and rapidly capture and route PO Requisitions and invoices; moving them through the system efficiently with Real-Time Approvals.

When all stakeholders have access, they can stay up to date and informed every step of the way; even on the road, streamlining the entire P2P process.

Everyone has access to information like invoice number, PO number, related documentation as well as the status of the invoice to ensure speedy approvals and faster payments.

Automatic Data Population:

Businesses can save time by capturing invoices electronically with an automated solution that extracts and stores key summary and detail data, and simultaneously pushes the information to a secure repository and your ERP accounting system.

By reducing double data entry, you reduce not only the time it takes for the information to enter multiple systems, you also reduce costly human error.

Advanced Reporting Tools:

Real-time data produces real-time reporting. AP departments and managers have great visibility and financial oversight via portals, dashboards and reports that just isn’t possible when that invoice is sitting on someone’s desk.

And because invoices are tracked from the moment they enter the system, managers can review the status of an invoice, invoices held for exceptions, duplicates, or approvals to resolve issues promptly and eliminate expensive late payment penalties.

Early Pay Discounts:

Better communication means better coordination of workflow from the time you receive the invoice until it is paid. By managing the payment process more effectively, you can eliminate late payment fees and take advantage of early payment discounts from suppliers.

Teams can work to negotiate early payment discounts with suppliers and better manage the procure-to-pay process by talking to their suppliers about the benefits of automatic invoice processing.

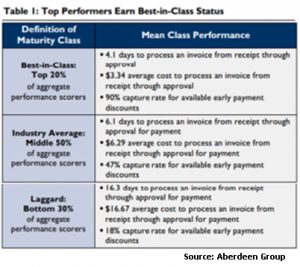

As shown in Table 1, Best-in-Class companies have a 90% capture rate for early pay discounts, versus laggards who only have an 18% capture rate

Once you develop a track record of early and on-time payments, you can better negotiate payment discounts that offer financial incentives for your business.

Once you develop a track record of early and on-time payments, you can better negotiate payment discounts that offer financial incentives for your business.

Reduce Costs:

What if you could reduce the time it took to process an invoice from 16.3 days to 4.1 days? Or cut your processing cost from $16.17 to $3.34 per invoice?

If your company processes 500 invoices a month, it can cost as much as $67,140 in paper, processing, labor and other costs. Imagine what you could do if you reduced that by even 30-50 percent.

Decrease Errors:

Streamlining the entire P2P process allows businesses to manage the entire lifecycle of a purchased good or service, from procurement, to receipt of the invoice, utilizing approval routing to ensure accuracy of the purchase, and making certain that the invoice and payment of that invoice is processed quickly—resulting in fewer errors.

Alerts are sent when deadlines are missed help to make your team more proactive and eliminate the chance for late or non-payment. Exceptions can be routed to the appropriate person instantly for resolution.

With today’s cloud-based technology, it is easy to centralize and standardize all of your procurement and invoice management processes for greater visibility and efficiency that ultimately lead to improved cash flow.

From reducing Maverick Spend, or increasing the number of early-pay discounts or simply eliminating manual processes, there are many reasons to implement an end-to-end P2P solution. Once you start, there are numerous opportunities for you to expand business processes automation to improve other areas of your business.

It’s the 21st Century, after all. Let’s take advantage of all it has to offer.

For up-to-date news on the latest industry trends, solutions, tips and tricks, click on the ‘LinkedIn button below to ‘Follow Us’.

Who is ISS Group?

All of our Solutions are ‘seamlessly’ integrated with QAD EE and SE, and are 100% Web-based providing (24×7 access)

ISS Group delivers Solutions which Digitize Business Processes to Connect People and Processes via the Cloud, Mobile devices, and Social Networks

55 Madison Ave, Suite 400

Morristown, NJ 07960

Toll Free: 888-547-7476

Direct: (973) 729-0013

www.issgroup.com